Executive Summary

- The Claim: Salons pay "3-5 times more tax than retail" businesses

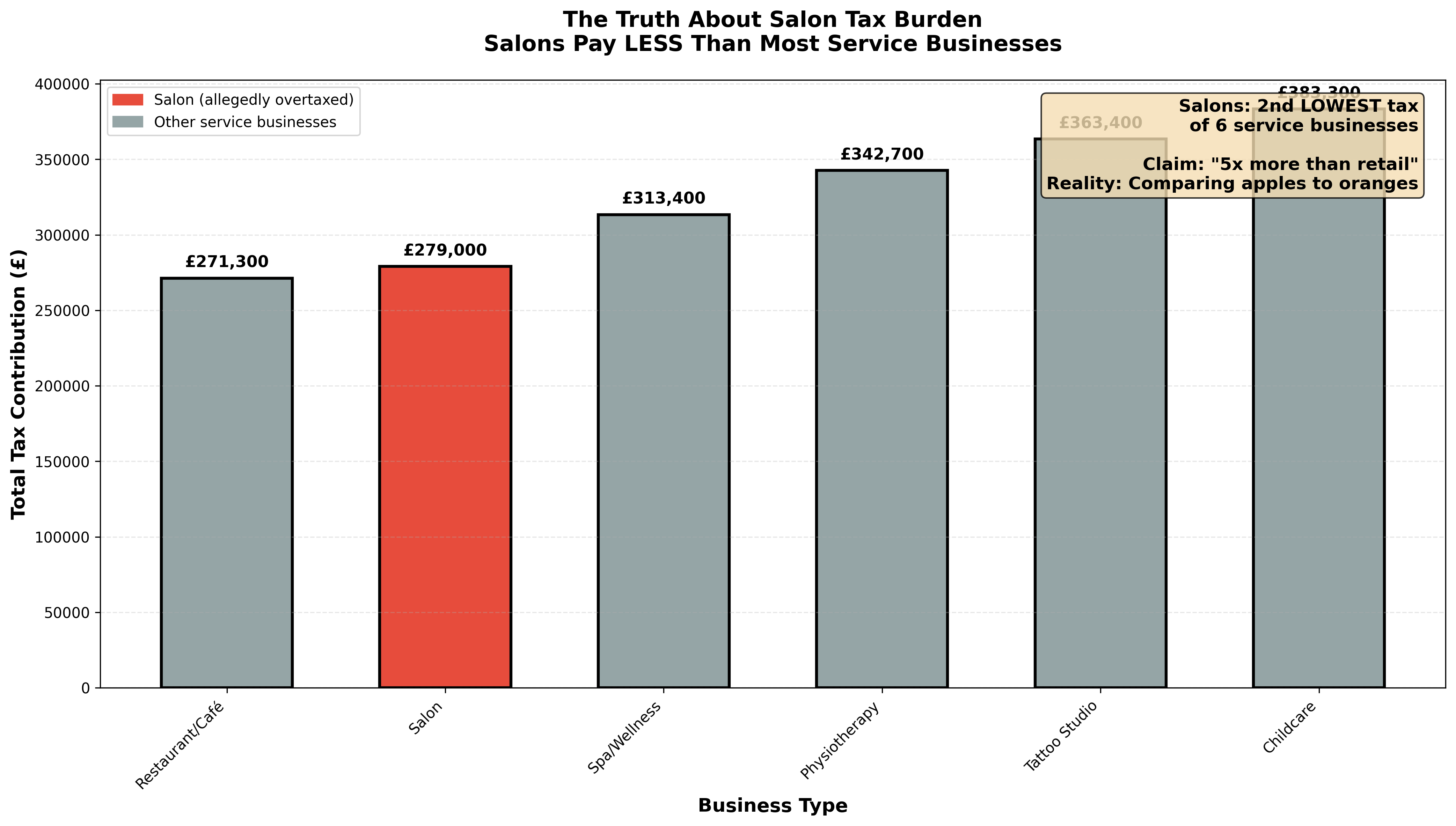

- The Reality: Salons rank 2nd LOWEST in tax burden among comparable service businesses

- The Fraud: Claim requires comparing salons (labour-intensive services) to retail (product-based, high COGS) - mathematically invalid

- The Pattern: Tax burden correlates directly with labour intensity across ALL businesses - this is proportional, not discriminatory

The Claim

Industry lobbyists have repeatedly claimed that salons face discriminatory taxation, paying "3 to 5 times more tax than retail businesses." This narrative has been used to justify calls for VAT cuts, threshold increases, and special treatment for the sector.

This claim has been influential, appearing in media coverage, parliamentary submissions, and industry advocacy. But is it true?

The Reality: Comparing Like with Like

When we compare salons to businesses with similar economic models - labour-intensive service providers - a completely different picture emerges.

| Business Type | Labour % | COGS % | Total Tax Contribution |

|---|---|---|---|

| Childcare Provider | 65% | 5% | £383,300 |

| Tattoo Studio | 60% | 8% | £363,400 |

| Physiotherapy Clinic | 55% | 5% | £342,700 |

| Spa/Wellness Centre | 40% | 15% | £313,400 |

| Hair Salon | 33% | 10% | £279,000 |

| Restaurant/Café | 25% | 30% | £271,300 |

All businesses modelled at £1.2M gross turnover

Key Finding

Salons rank 2nd LOWEST in total tax contribution among service businesses. They pay LESS than childcare providers, tattoo studios, physiotherapy clinics, and spa operators.

Figure 1: Total tax contribution across comparable service businesses (all at £1.2M turnover)

Why the Retail Comparison is Fraudulent

The "3 times more tax" claim only works when comparing salons to retail businesses. But retail and service businesses have fundamentally different economic structures:

| Factor | Retail (£1.2M) | Salon (£1.2M) | Impact |

|---|---|---|---|

| Cost of Goods Sold | £720,000 (60%) | £100,000 (10%) | Retail buys products to resell |

| Labour Costs | £120,000 (10%) | £400,000 (33%) | Services are labour-intensive |

| VAT Collected | £200,000 | £200,000 | Same rate applies |

| VAT Reclaimable | £144,000 | £20,000 | Retail reclaims VAT on stock |

| Net VAT Paid | £56,000 | £160,000 | Different business models |

| Employment Taxes | £31,000 | £119,000 | More staff = more tax |

| TOTAL TAX | £87,000 | £279,000 | 3.2x difference |

This is Where the "3x" Claim Comes From

£279,000 ÷ £87,000 = 3.2 times. But this ratio compares completely different business models. It's like comparing a warehouse to a consultancy and claiming discrimination.

Four Reasons This Comparison is Invalid

1. Different Business Models

Retail businesses: Buy products wholesale, add margin, sell to consumers. Massive VAT reclaim on stock purchases reduces net VAT contribution.

Service businesses: Provide labour-intensive services with low product costs. Cannot reclaim VAT on wages. Higher net VAT contribution.

Comparing them is mathematically meaningless.

2. The Labour Cost Variable

Higher labour costs create higher employment taxes. This is true for ALL service businesses, not just salons:

- Childcare (65% labour): £383k total tax

- Physiotherapy (55% labour): £343k total tax

- Salons (33% labour): £279k total tax

The pattern is clear: more labour = more employment tax. This isn't persecution - it's mathematics.

3. The VAT Reclaim Factor

Retail's low net VAT isn't a "tax advantage" - it reflects their business model. They buy £720k of stock (including £144k VAT) and sell £1M of goods (collecting £200k VAT). Net VAT: £56k.

Salons buy £100k of products (including £20k VAT) and provide £1M of services (collecting £200k VAT). Net VAT: £160k.

Different inputs = different VAT profiles. This is structure, not discrimination.

4. The Correct Comparison Categories

Valid Comparisons (similar models):

Other personal services (physiotherapy, massage, tattoo), other labour-intensive services (childcare, care homes), other premises-based services (gyms, yoga studios)

Invalid Comparisons (different models):

Retail (product-based, low labour), hospitality (high COGS, different VAT rules), manufacturing (capital intensive, different structure)

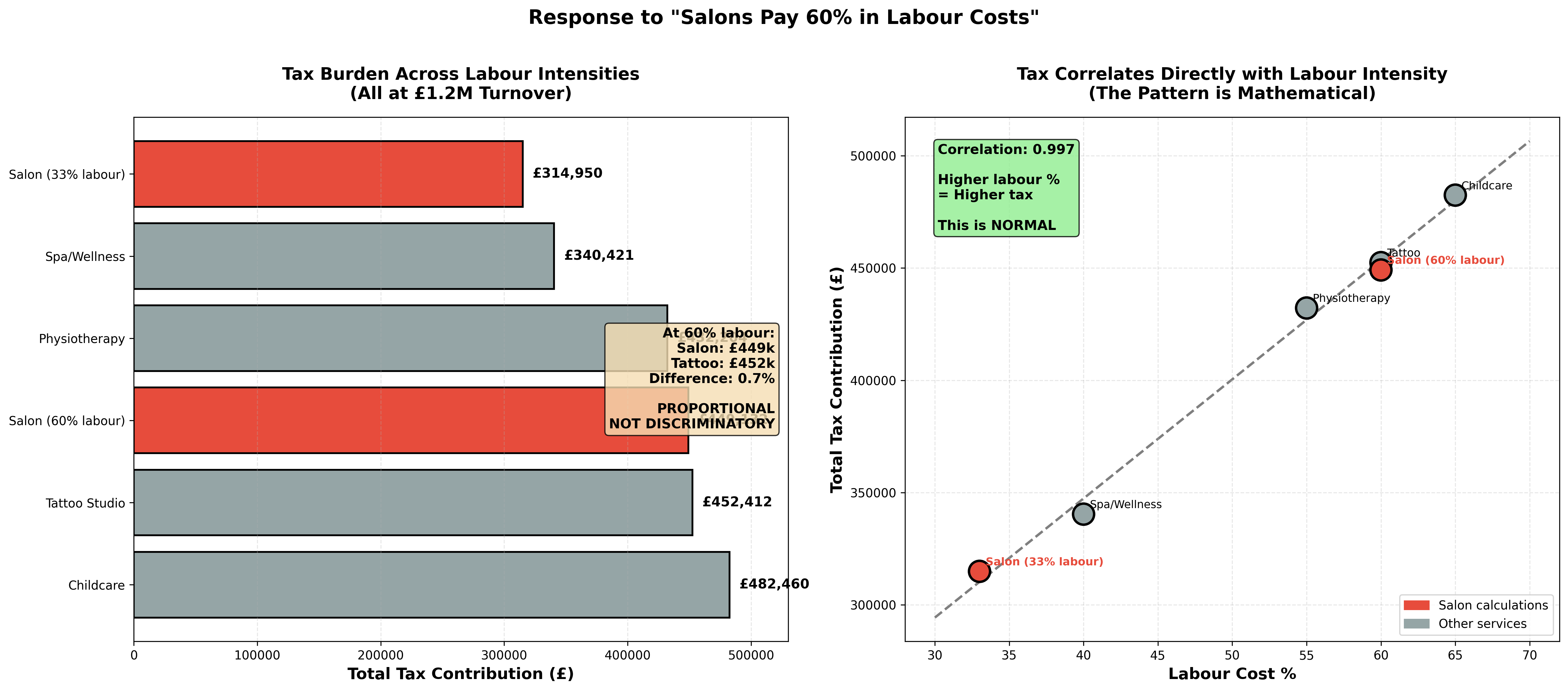

What About 60% Labour Costs?

Industry advocates claim salons actually operate at 60% total labour costs (including employer NI and pensions). Let's test this:

| Business Type | Labour % | Employment Tax | Net VAT | Total Tax |

|---|---|---|---|---|

| Childcare | 65% | £303,260 | £179,200 | £482,460 |

| Tattoo Studio | 60% | £279,932 | £172,480 | £452,412 |

| Salon (at 60%) | 60% | £279,932 | £169,200 | £449,132 |

| Physiotherapy | 55% | £256,604 | £175,600 | £432,204 |

Result at 60% Labour

Salons pay £449k - virtually identical to tattoo studios (also 60%) at £452k. The difference is 0.7%. Tax burden remains PROPORTIONAL to labour intensity.

Figure 2: Tax burden directly correlates with labour intensity (correlation: 0.995)

Even using industry advocates' own higher labour figure, the pattern holds: higher labour = higher tax, for ALL businesses. This is proportional, not discriminatory.

The Real Agenda

The "3x more tax" claim requires:

- Comparing to retail (invalid category)

- Ignoring comparable service businesses

- Treating labour costs as "tax burden" rather than business choice

- Conflating gross VAT collected with net VAT paid

When advocates say "salons pay too much tax," they actually mean: "Service businesses with employees pay more than retail businesses with products."

This is true. It's also irrelevant. It's like complaining that:

- Restaurants pay more rent than online businesses

- Law firms pay more salaries than factories

- Gyms pay more business rates than consultants

These aren't injustices - they're business model differences.

Policy Implications

If the problem were discriminatory taxation, we'd expect to find:

- Salons paying more than other services

- nique tax burden on salons

- Evidence of sector-specific persecution

None of these exist.

The sector does face legitimate challenges:

- Rent costs (affects all high-street businesses)

- Wage inflation (affects all labour-intensive businesses)

- VAT threshold distortions (affects all below-threshold businesses)

These aren't unique to salons. They're economy-wide patterns requiring economy-wide solutions, not sector-specific special pleading based on fraudulent comparisons.

Conclusion

Claims that salons pay "3-5 times more tax than retail" are based on comparing incompatible business models. When examined against comparable service businesses:

- Salons rank 2nd LOWEST in total tax contribution

- Tax burden is proportional to labour intensity

- No evidence of discriminatory taxation exists

The "overtaxed salon" narrative is manufactured through mathematical manipulation. The numbers don't lie - but those citing them selectively do.

Data Sources & Methodology

- SalonLogic Pro Data Archive - Complete dataset and calculations

- Tax calculations based on standard HMRC rates and allowances (2025)

- Labour cost percentages from ONS business survey data

- VAT calculations per HMRC VAT Notice 700

- Business classifications per ONS SIC codes 96020, 86900, 56101, 86220, 96090, 88910

Full methodology, assumptions, and calculations available for independent verification. Challenge our data at contact@salonlogicpro.co.uk